Funds Data

EDI provides a wide range of funds data including

offshore, REITs, Unit Trusts, Investment NAVs

corporate actions and more.

Try EDI

Funds data requires expertise. Whether we’re pricing REITs, pricing non-US investments or simplifying your offshore tax liability calculations, EDI and our trusted partners bring the specific expertise you need for data you can trust.

A wide range of funds data sets, customized for you.

Data you need. Value you deserve.

Flexible licensing

Perpetual ownership rights

mean you own your data.

Use it. Never lose it.

Learn More

Quality Data

Checked and validated.

We stand by our data so you can create solutions around it with confidence.

Learn More

Competitive Pricing

Customized data sets let you

pay for what you need,

not what you don’t.

Learn More

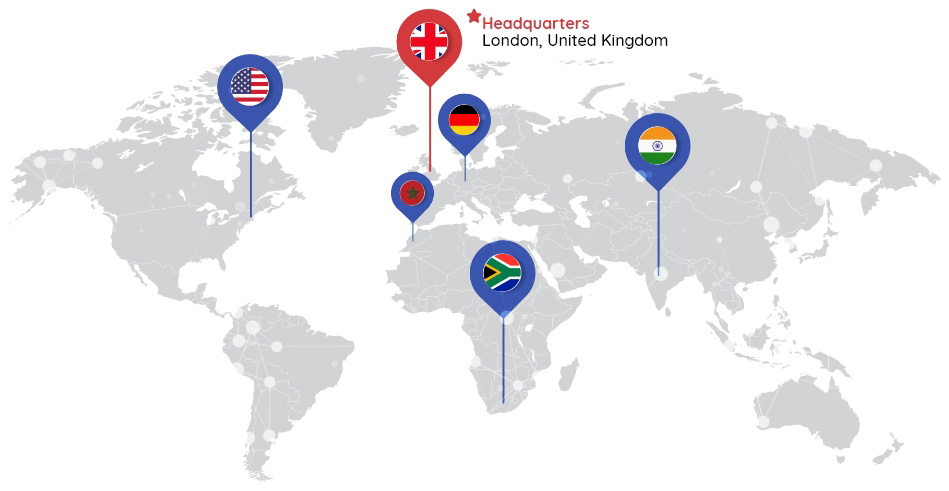

Doing market data differently.

EDI has served the financial industry around the world since 1994. EDI’s team of 500 people delivers quality data at scale: 700 sources, 35 languages, 25 million corporate actions every year.

At EDI, agreements are specific to each client. That means you buy the data you need – and no more. To learn how you can try our data at no cost, contact us now.

At EDI, agreements are specific to each client. That means you buy the data you need – and no more. To learn how you can try our data at no cost, contact us now.

Try EDI

How do I know the data is high quality?

Founder Jonathan Bloch explains EDI’s quality assurance measures and addresses 4 more transition concerns in our video series, “5 questions to help you choose your next data provider.”